Please note that the form linked above is a sample and should not be completed.

There are three easy ways to send in your form!

REMEMBER: Sign and date your form

1. Email: portabilityandconversions@selmanco.com

You can fill out the form below to receive an estimate of the monthly cost to continue your coverage. The quote will be delivered to you via email, but completing this form will not result in you receiving any additional email communications. If you do not see your quote email in your inbox shortly after completing the form, please check your junk mail folder.

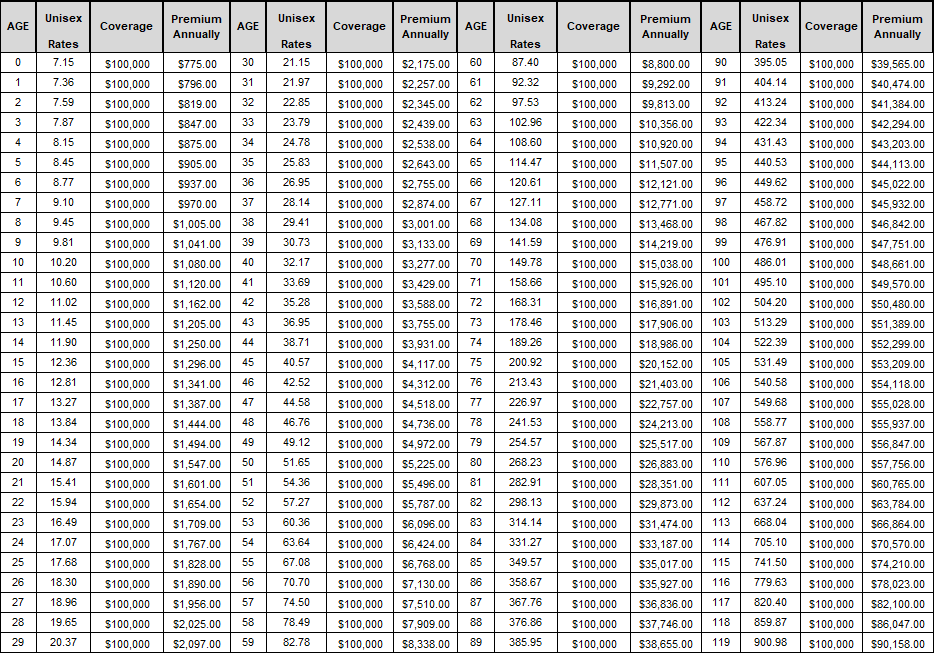

The rate examples below will assist you in calculating the approximate cost to continue your coverage. These costs are approximate and may vary based on the specifics of your group policy. Please refer to your group policy for specific rules/options (i.e. the maximum amount of coverage that can be continued, any restrictions, etc.) applicable to the coverage you had with your employer.

Determine your age using the birth date that is closest to your anticipated effective date of insurance. In order to determine your anticipated effective date, use the date you've been told your coverage is ending and then add 32 days. This is your anticipated effective date of insurance.

Conversion Individual Whole Life

The conversion products and rates are subject to change at any time; however, once the policy has been issued, rates will never change.

Annual Premium = (Rate x (Coverage / 1,000)) + $60 annual administration fee

(Example is 100K. If you elect another amount, please use the formula above.)

*In some states, the individual Whole Life insurance policy may be preceded by a one-year Term Insurance policy. Please see your Group Policy to determine if this option applies to you.

The Life Conversion option provides the opportunity for you to obtain an individual whole life insurance policy that accumulates cash value and is offered at individual insurance rates. There are no mandatory age reductions and coverage can continue with premium payment until the Scheduled Maturity Date (standardly age 121) at which time the cash surrender value is paid to the insured.

If coverage is ending because The Hartford Group Life policy is terminating or coverage for a class of employees is terminating, some restrictions may apply. If coverage is ending for any other reason, you can generally convert up to the full amount of your terminating coverage. Conversion is also available to your dependents if they had coverage under your group plan. If you live in the state of New York or West Virginia, the Individual Whole Life insurance policy may be preceded by a one-year term. Please refer to The Hartford's Group Life policy for information. Premiums for a Life Conversion policy are substantially higher than your Employer Group plan rates.

Under the Portability option you may obtain a group life insurance policy to continue 50%, 75%, or 100% of the amount of life insurance coverage (Basic, Supplemental, or both) you had under the Group policy up to a maximum amount, generally $500,000 depending upon the provisions of the employer's group policy. The Portability policy provides group term coverage and is available to you provided you have not yet reached age 85.

The Portability option may also be available to your dependents if you carried dependent coverage under the employer's group policy and if the group policy includes portability as an option for dependents. The amount of coverage you elect to port is reduced by 35% at ages 65, 70, 75; 25% at ages 80, 85, 90, 95 and coverage terminates at age 99. You will be eligible for Life Portability if you experience a loss of coverage as the result of a change in your employment status, change in marital status, you or a dependent has experienced an age reduction or maximum age limit, you have retired or you have reached the end of an employer-sponsored continuation provision.

Note: Portability is not available if your employer is terminating the group policy. If you choose to elect the Waiver of Premium provision as outlined in your Contract, you are not eligible for Portability. The same applies if you choose to elect Portability, Waiver of Premium would not be available. Additional restrictions may also apply. Premiums for a Life Portability policy may be higher than the employer group policy rates and rates increase every five years (years in which your age on your birthday ends in 5 or 0, for example 45 or 50).

If you would like more information on the differences between portability and conversion, please look over the Side by Side Employee Guide.

If I request a quote, how does The Hartford determine the amount of coverage to quote?

The Hartford will contact your employer to obtain the amount of coverage you had in effect under the group plan. The quote is based upon the amount of coverage you had in effect under the group plan, as well as applicable plan provisions.

If I receive a quote for coverage, does this mean I qualify for the coverage amount quoted?

The amount quoted is not a guarantee that a policy will be issued in that amount. Upon receipt of your application for coverage, The Hartford will perform an eligibility review to determine if the amount of coverage you have requested can be granted based on the coverage you had in effect under the group plan as well as plan provisions.

If I start to work for a new employer and obtain coverage under that employer’s Group plan, will that Group coverage impact any conversion or portability policy that I may have purchased?

If you obtain coverage under a new employer’s Group plan, your portability or conversion policy will remain in effect provided you continue to pay the required premiums. However, benefits payable under portability and/or conversion policies may be affected by the amount of your other coverage.

What if my employer hires me back and/or if my leave/furlough is temporary? Will this impact my portability or conversion policy?

Yes, benefits payable at the time of claim may be impacted. Please notify us if you returned to work and would like to terminate your portability or conversion policy.

What should I do if I have not received a Notice of Conversion and/or Portability Form?

Please contact your employer if you have not received the form within 15 days from your coverage loss.

What is my policy effective date?

The effective date of a Life Conversion policy is the 32nd day following the group coverage termination date. The effective date of a Life Portability Policy is the day following the group coverage termination date.

If my application for coverage is not approved by the effective date, am I still covered?

Yes, if your application is approved, the effective date of your policy will be retroactive to the date indicated above.

I understand that there is no medical underwriting or physical exam required, but can I still be denied for coverage?

Your request for coverage can be denied if you do not meet the timeliness requirements as outlined on your Notice of Conversion and/or Portability Form. Coverage can also be denied if it exceeds the amount you had in effect under the Group Policy, you are over the eligibility age, or if it does not align with your Group Policy's plan provisions.

Email: portabilityandconversions@selmanco.com

Hours of Operation: Monday-Friday from 9AM to 7PM ET

Mailing Address: The Hartford, Portability and Conversion Unit, P.O. Box 43786, Cleveland, OH 44143-0786

Fax: 1-440-646-9339

Telephone: 1-877-320-0484

The quotations provided on this website are an estimate and non-binding. The sample quotes are based on standard eligibility for a Group Policy that offers Portability Life with Accidental Death coverage. To obtain a personalized, formal, written quotation, you will need to complete the Employee page of the Notice of Conversion and/or Portability Form. This form is provided by your employer within 90 days of coverage loss. Please note that your employer must complete and sign/date the Employer page. The Employee and Employer pages of the Notice of Conversion and/or Portability Form must be received within 31 days of the Employer's signature date to be eligible for a quote. Once received, we will validate your eligibility for coverage and provide the written quotation and application. Standard turnaround time for written quotes is 10-15 business days.

The Hartford Insurance Group, Inc., (NYSE: HIG) operates through its subsidiaries, including underwriting company Hartford Life and Accident Insurance Company, under the brand name, The Hartford®, and is headquartered at One Hartford Plaza, Hartford, CT 06155. For additional details, please read The Hartford’s legal notice at www.TheHartford.com. All benefits are subject to the terms and conditions of the policy. Policies underwritten by the underwriting company listed above detail exclusions, limitations, reduction of benefits and terms under which the policies may be continued in force or discontinued.

The insurance coverage is administered by Selman & Company, LLC (SelmanCo). SelmanCo is Third-Party Administrator for the insurance plan, on behalf of Hartford Life and Accident Insurance Company.

3262203 09-25