Call Today (301)-804-9887

When Employers offer the TRICARE Supplement Insurance Plan as part of their comprehensive benefits portfolio, it’s a win-win scenario.

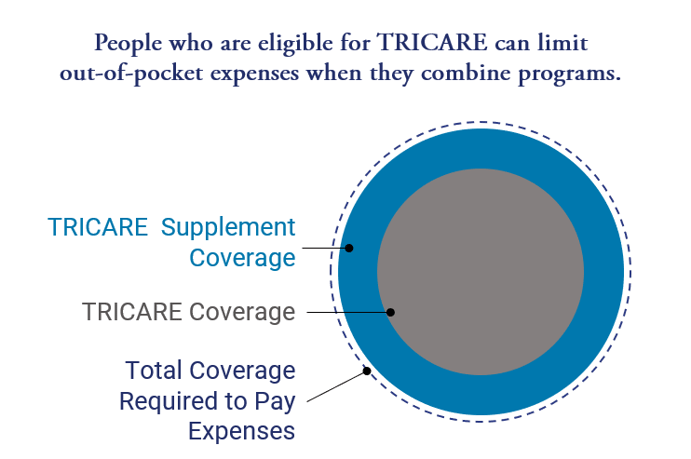

Employees who are eligible for government-sponsored TRICARE health insurance can get help saving on co-pays, prescriptions, and cost shares. Supplement insurance helps reimburse them for covered expenses that TRICARE doesn't pay.

*When offered as a voluntary benefit.

Complete this form to request a proposal that's customized for your group.

All benefits are subject to the terms and conditions of the policy. Policies underwritten by Hartford Life and Accident Insurance Company detail exclusions, limitations, and terms under which the policy may be continued in full or discontinued. Complete details are in the Certificate of Insurance issued to each insured individual and the Master Policy issued to the policyholder. This program may vary and may not be available to residents of all states. The TRICARE Supplement Plans are administered by SelmanCo and underwritten by Hartford Life and Accident Insurance Company, One Hartford Plaza, Hartford, CT 06155.

The Hartford Insurance Group, Inc., (NYSE: HIG) operates through its subsidiaries under the brand name, The Hartford, and is headquartered in Hartford, Connecticut. For additional details, please read The Hartford's legal notice at www.TheHartford.com. Photo Credits: DoD. The appearance of U.S. Department of Defense (DoD) visual information does not imply or constitute DoD endorsement. AGP-5942, AGP-5943, AGP-5944. Privacy Policy | HIPAA Notice

TRICARE Form Series includes GBD-3000, GBD-3100, or state equivalent.

TS-Employer-Proposal-Gen-012026